Surface Mount Technology (SMT) reflow oven are the cornerstone of modern PCB manufacturing, directly determining soldering quality, yield rates, and overall production efficiency. As we advance into 2025, the global reflow oven market is undergoing a significant transformation, fueled by innovations in automation, energy sustainability, and digital integration.

This article provides a comprehensive analysis of the top 10 SMT reflow machine brands worldwide, leveraging the latest 2025 financial data, technological breakthroughs, and market performance. Whether you're an EMS provider, an automotive electronics manufacturer, or a growing startup, this guide, complete with comparative visuals and data-driven insights, will empower you to make the most informed decision for your production line.

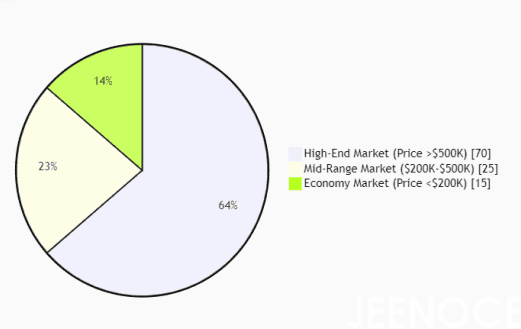

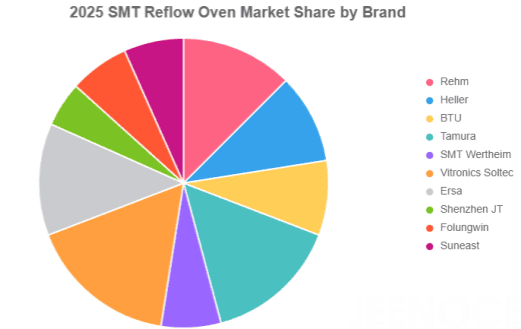

The global SMT reflow machine market is characterized by distinct segments, each dominated by players with complementary strengths. The following chart illustrates the 2025 market share by brand, with Rehm Soltecleading the high-end segment (40% combined share), while Shenzhen JT and Folungwin dominate the economy segment (30% combined share).

Note: Data as of August 2025,revenues for private firms like Suneast are estimated based on market trends and may vary.

Our ranking is based on a multi-faceted evaluation to ensure objectivity and depth:

· Performance Metrics: Temperature uniformity (±0.5°C), nitrogen consumption, and energy efficiency.

· Technological Innovation: Advancements in hot air convection, vacuum reflow, and IoT/MES integration.

· Cost-Effectiveness: Analysis of initial investment, operational costs, maintenance, and long-term ROI.

· Brand Reputation & Support: Global service network robustness, training quality, and spare parts availability.

Data Sources: We amalgamate data from official company financial reports (SEC, TDnet), reputable industry analyses (MarketsandMarkets, Gartner, ResearchAndMarkets), and cross-verified estimates for private entities to ensure reliability.

Below is a detailed comparison of the top brands, built on the most up-to-date data available. It delivers a clear snapshot of where each brand stands in the market and how financially soundthey are.

Rank | Brand Name | Country | Est. 2025 Revenue (M USD) | Core Strength & Differentiator | Target Segment |

1 | Rehm Thermal Systems | Germany | ~75 | Vacuum reflow, Nitrogen-saving, ±0.5°C stability | High-End / Automotive |

2 | Heller Industries | USA | 69.8 | AI Process Optimization, Hot Air Reflow | Mid to Large-Scale |

3 | BTU International | USA | ~100 | Precision Temperature Control | High-End / Aerospace |

4 | Tamura Corporation | Japan | ~182 (Q1) | Compact/Benchtop Systems, Robotics Integration | Mid-Range / Consumer |

5 | SMT Wertheim | Germany | 50-70 | Vacuum Reflow (22% Market Share) | Ultra-High-End / Specialty |

6 | Vitronics Soltec (ITW) | Netherlands | ~232 (Segment) | High-Precision Zones, ZEVAm System | High-End / Automotive |

7 | Ersa (Kurtz Ersa) | Germany | ~190 (Segment) | Reliability, Selective Soldering | Industrial / Automotive |

8 | Shenzhen JT Automation | China | 30-50 | Cost-Effectiveness, AI Defect Inspection | Economy / High-Mix |

9 | Folungwin | China | 40-60 | Rapid Customization, Value Pricing | Economy / High-Volume |

10 | Suneast Industrial | China | N/A (Estimated 20-30) | Fast Growth, Domestic Demand | Emerging Economy |

Table: 2025 Financial and Strategic Overview of Top Reflow Oven Brands. Data compiled from company reports and market estimates as of August 2025; private firm revenues estimated.

Rehm leads with innovations in vacuum reflow and nitrogen-saving technology, achieving exceptional temperature stability (±0.5°C). Their systems are favored in automotive and high-reliability applications. In Q1 2025, Rehm reported a 12% revenue growth, reflecting strong market acceptance. A case study showed an 18% defect rate reduction at an EMS provider using Rehm ovens for automotive control units.

Pros: Industry-leading vacuum reflow and precision; strong global support via partners like Heller’s network in the USA.

Cons: Higher initial cost may challenge budget-conscious buyers.

Heller’s AI-driven Nexus series enhances yield and efficiency, ideal for medium to large-scale production. With $69.8M revenue in 2025, Heller targets sustainability, aiming for a 54.6% emissions reduction by 2033. Their hot air reflow technology ensures consistency.

Pros: AI optimization, reliable hot air reflow.

Cons: Limited presence in ultra-high-end vacuum reflow markets.

Despite a 23% Q3 revenue decline, BTU maintains strong cash flow and excels in precision temperature control for aerospace. Their R&D focus ensures niche market relevance.

Pros: Superior precision for high-reliability applications.

Cons: Recent revenue dip may signal market challenges.

Tamura’s Q1 2025 revenue of ~$182M reflects success in compact and benchtop systems with robotics integration, popular in consumer electronics.

Pros: Flexible, compact designs for mid-range needs.

Cons: Limited scalability for ultra-large production lines.

Holding a 22% vacuum reflow market share, SMT Wertheim excels in ultra-high-end applications with unmatched precision.

Pros: Leading vacuum reflow technology.

Cons: High cost and specialized focus limit broader adoption.

With ~$232M segment revenue, Vitronics Soltec’s ZEVAm system and high-precision zoning suit automotive electronics.

Pros: Excellent precision and robust support network.

Cons: Complex systems may require extensive training.

Ersa’s focus on reliability and selective soldering earns it a strong reputation in industrial and automotive sectors.

Pros: Durable, reliable systems.

Cons: Less competitive in cost-sensitive markets.

Offering cost-effective solutions with AI defect inspection, JT Automation suits high-mix, low-volume production. Estimated revenue: $30-50M.

Pros: Affordable, AI-driven features.

Cons: Limited global service network.

Folungwin’s rapid customization and value pricing make it ideal for high-volume production. Estimated revenue: $40-60M.

Pros: Fast customization, low cost.

Cons: Aftersales network weaker in Europe and USA.

Suneast’s rapid growth is driven by domestic demand in emerging economies. Estimated revenue: $20-30M.

Pros: Competitive pricing, fast market expansion.

Cons: Limited global brand recognition and data transparency.

· Temperature Control: Rehm and Heller set the standard with dual-track monitoring systems, ensuring impeccable thermal profiles across PCBs (±0.5°C uniformity).

· Energy Efficiency: Nitrogen recycling systems (Rehm, SMT Wertheim) reduce gas consumption by up to 30%, lowering costs.

· User Interface & Integration: Digital touchscreens with MES integration are standard. Heller’s USA-based support enhances integration with systems like SAP.

· Maintenance & Service: Top brands offer 24/7 global support with <2-hour response times, with Heller and Vitronics Soltec excelling in the USA and Europe, respectively.

Selecting the ideal reflow oven requires a strategic approach:

· Assess Production Needs: Evaluate volume, board sizes, complexity (e.g., high-mix PCBs), and process needs (e.g., vacuum for void reduction).

· Evaluate Support & Service: Prioritize suppliers with robust local support.

· Consider Scalability: Choose modular systems for future upgrades.

· Conduct ROI Analysis: Factor in energy, nitrogen, maintenance costs, and yield improvements. For instance, Rehm’s nitrogen-saving systems can reduce operational costs by 20%.

Further Reading: You can refer to the article titled The Ultimate Guide to Choosing the Right Reflow Soldering Machine for Your Needs.

As Rehm's strategic partner in China, JEENOCE delivers end-to-end solutions beyond equipment sales, covering equipment confirmation, international logistics, customs clearance, installation, calibration, in-depth MES integration, and local support.

A leading new energy vehicle electronics manufacturer encountered yield issues with its complex battery management system (PCBA). It adopted a Rehm vacuum reflow oven, with deployment and support provided by JEENOCE.

· Realized a 20% yield improvement

· Reduced void rates to below 1%

· Significantly enhanced product reliability

JEENOCE's 24/7 technical support ensured:

· Response time under 2 hours for critical issues

· Key parts delivery within 4 hours

· Minimized production downtime and maximized operational efficiency

The 2025 SMT reflow oven market emphasizes digitalization, energy efficiency, and flexible production. Choosing the right equipment involves balancing technology with robust support. Brands like Rehm and Heller, with strong local partners, ensure future-proof solutions.

A: Nitrogen reflow creates an inert atmosphere to reduce oxidation, improving solder joint quality. It’s critical for fine-pitch components and low-defect applications.

A: Use a profiling system with thermocouples per IPC-7532 guidelines to measure temperature variation across PCB zones.

A: Rehm, Ersa, and Vitronics Soltec excel due to precision and traceability for high-reliability applications.

A: Yes, Rehm’s ovens series integrates with MES platforms like SAP, enabling real-time monitoring and analytics.

A: Digitalization (IIoT), green manufacturing (nitrogen savings), AI optimization, and modular designs for flexible production dominate.

ResearchAndMarkets, "Table-top Vacuum Reflow Oven Market Forecast 2025-2030"

Gartner, "SMT Equipment Trends 2025"

GlobalGrowthInsights, "Reflow Soldering Oven Market 2025-2034"

Future Market Insights, "Reflow Oven Market 2025-2035"

Statista, "Global SMT Equipment Market Data 2025"

Message